Ukraine sees record number of self-employed in five years: where most are concentrated

Kyiv • UNN

The number of self-employed professionals in Ukraine has increased by 4% since the start of the full-scale war, reaching 28.3 thousand. In the first five months of 2025, they paid 292.29 million hryvnias in taxes, which is a third more than last year.

Almost UAH 300 million in taxes have already been paid by self-employed individuals in 2025, and the number of self-employed has been growing since the beginning of the full-scale war, according to data from the Opendatabot monitoring service, UNN writes.

Details

"28.3 thousand specialists engaged in independent professional activity - i.e., self-employed - are currently registered in Ukraine. This is a record figure for the last five years. Since the beginning of the full-scale war, the number of self-employed has increased by 1.1 thousand - approximately by 4%," the report says.

Where most are located

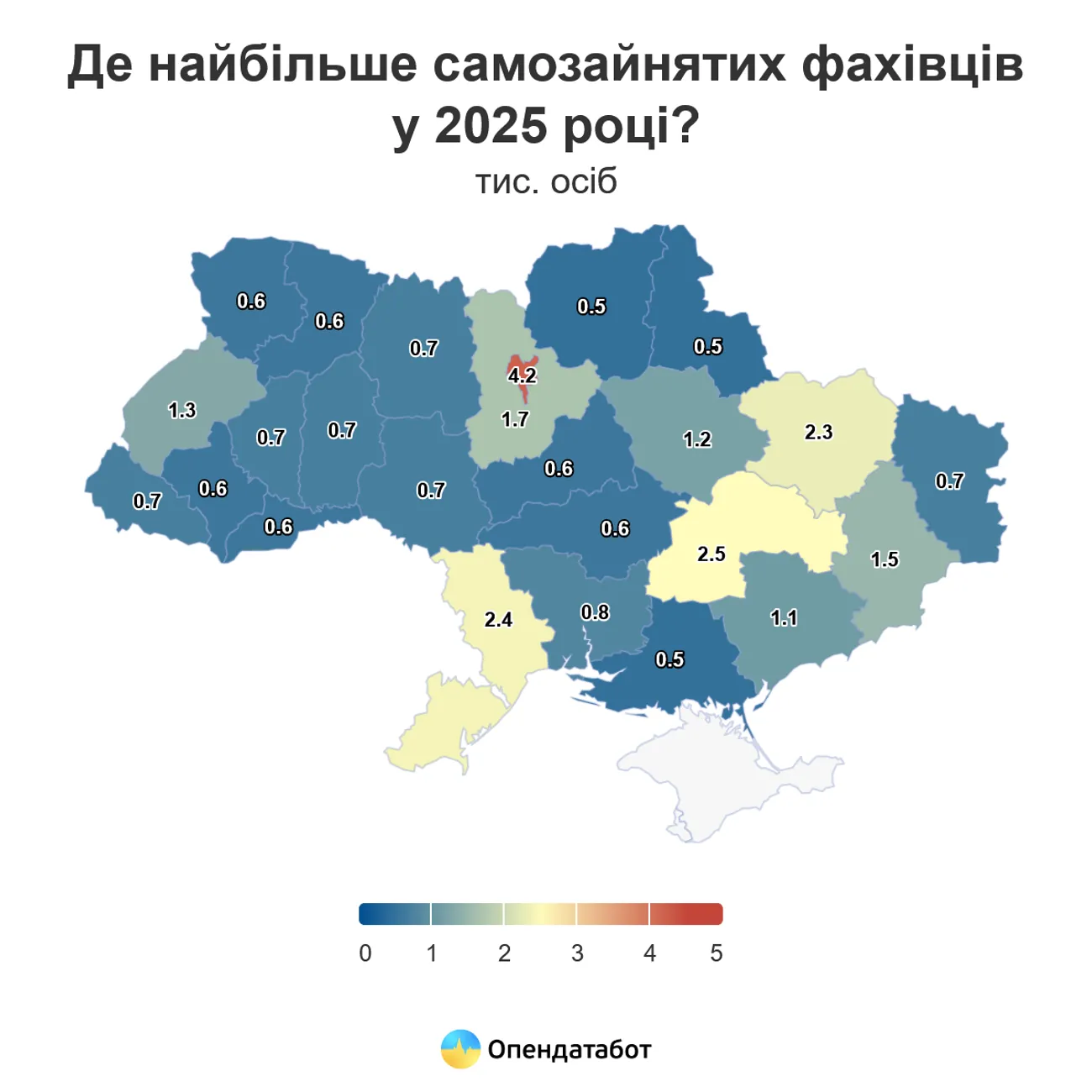

Most of these specialists work in Kyiv - 4.2 thousand. Next are Dnipropetrovsk region - 2.5 thousand and Odesa region - 2.4 thousand.

How much tax was paid

UAH 292.29 million in taxes were paid to the budget by self-employed individuals in the first five months of 2025. This is one-third more than in the same period last year. In total, UAH 603.16 million in taxes were paid by such specialists in the past year 2024. The amount increases every year.

UAH 38 thousand in taxes, on average, were paid by one self-employed person in Lviv region this year. In Kyiv - UAH 33 thousand, in Vinnytsia region - UAH 31 thousand. It is worth noting that independent professionals constitute only 1.4% of all self-employed individuals in Ukraine (including individual entrepreneurs).

No tax increase planned for private entrepreneurs - Ministry of Finance17.03.25, 10:58 • 63863 views

Context

In April, the Cabinet of Ministers approved a draft law on the implementation of international automatic exchange of information on income received through digital platforms. It provides for the taxation of income of self-employed individuals received from activities on digital platforms such as Uklon, Bolt, OLX, Prom, Rozetka, etc.