Over 98% of GDP: Ukraine's public debt exceeded UAH 9 trillion - Ministry of Finance

Kyiv • UNN

Ukraine's public debt reached UAH 9 trillion, or USD 213 billion, in 2025, increasing by 29.5% over the year. This accounts for 98.4% of the projected GDP, while the average maturity period doubled and the cost decreased.

Ukraine's public debt in 2025 exceeded UAH 9 trillion or USD 213 billion, increasing by almost a third over the year. Preliminarily, it amounts to 98.4% of the projected GDP in 2025, while the average maturity period more than doubled, and the average cost significantly decreased, the Ministry of Finance reported, writes UNN.

Details

The Ministry of Finance called the increase in public debt "objectively inevitable," explaining it by "significantly increased state budget needs in the security and defense sector." At the same time, the agency indicated that "under martial law, Ukraine ensures the improvement of key debt indicators."

"As of December 31, 2025, the total amount of Ukraine's state and state-guaranteed debt was UAH 9,042.7 billion (USD 213.3 billion), which is 29.5% (28.4% in dollar equivalent) more than at the end of 2024," the Ministry of Finance reported.

During 2025, the volume of Ukraine's state and state-guaranteed debt, as indicated, increased in hryvnia equivalent by UAH 2.061 trillion (USD 47.3 billion) "mainly due to an increase in long-term concessional financing from international partners."

The Ministry of Finance named the largest sources of state budget financing in 2025 as:

- ERA loans from G7 countries totaling USD 37.9 billion, which are partially accounted for as public debt;

- EU financing totaling USD 12.1 billion.

During the year, Ukraine's debt under concessional EU loans, as noted by the ministry, increased by UAH 1.654 trillion (USD 38.6 billion). Repayment payments for Ukraine Facility loans have a grace period of 11-12 years and can be compensated by EU countries. Servicing and repayment of ERA loans will be carried out from sources not related to the state budget, including income from frozen Russian assets, which does not create additional debt burden for Ukraine.

Structure

"As of the end of 2025, about 75% of Ukraine's state and state-guaranteed debt is external, with more than half of this debt being obligations to the EU (about 40% of all public debt)," the Ministry of Finance reported.

It is noted that EU financing is provided on exceptionally concessional terms. The rest of the external debt falls on other partner states and international financial organizations.

"The share of commercial external debt has been reduced to less than 10%. About 22% of the debt portfolio is domestic public debt. Another about 3% falls on state-guaranteed debt, the share of which has been consistently decreasing over the past four years," the report says.

According to preliminary calculations, Ukraine's public debt to projected GDP in 2025 is 98.4%

Public Debt Transformation

From 2021 to 2025, Ukraine, the Ministry of Finance reported, "carried out a qualitative transformation of public debt, significantly improving its maturity and cost structure." The weighted average maturity of public debt, as indicated, increased from 6.3 years in 2021 to 13.37 years in 2025, i.e., more than 2.1 times. The maturity of external public debt during this period increased from 6.3 years to 15.75 years, or 2.5 times, "which significantly reduced refinancing risks."

In parallel, according to the Ministry of Finance, "there was a decrease in the cost of public debt": the weighted average cost of public debt decreased from 7.2% in 2021 to 4.55% in 2025, i.e., 1.6 times. The cost of external public debt, according to the report, decreased from 4.5% to 1.9%, or more than 2.3 times, "due to the increasing share of concessional financing from international partners."

"Such positive changes significantly reduce refinancing risks and support the sustainability of public finances in the medium term," the Ministry of Finance noted.

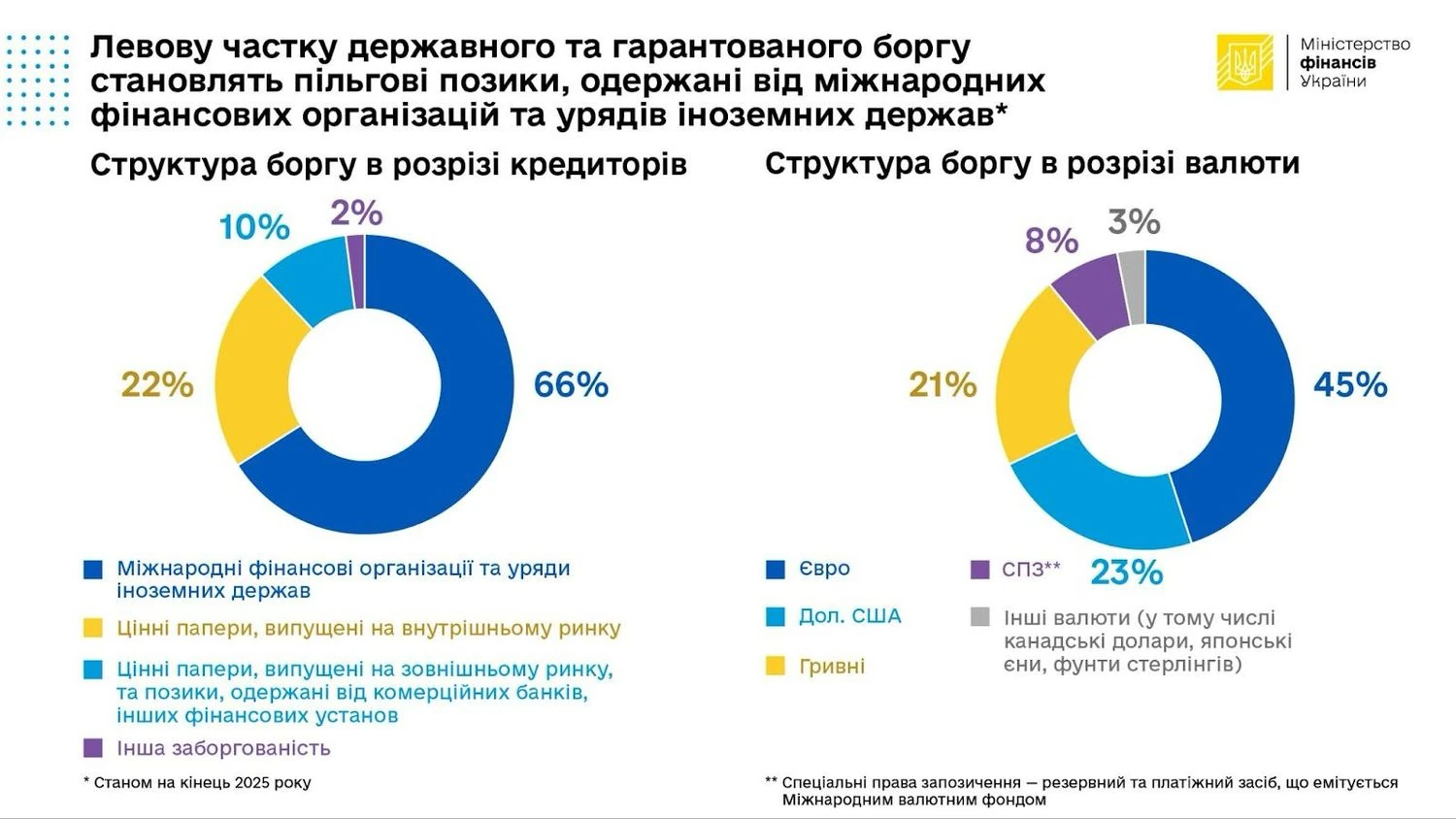

As indicated by the Ministry of Finance, in terms of creditors, "the lion's share of state and state-guaranteed debt consists of concessional loans received from international financial organizations (IFIs) and governments of foreign states - 66%, issued securities on the domestic market - 22%, issued securities on the external market and loans received from commercial banks, other financial institutions - 10%, other debt - 2%".

In terms of the currency structure of state and state-guaranteed debt, the share of the euro is 45%, the US dollar - 23%, the hryvnia - 21%, SDRs - 8%, and in other currencies, including pounds sterling, Canadian dollars, and Japanese yen - 3%.

Restructuring

"In December 2025, Ukraine restructured state derivatives (GDP warrants) by exchanging them for a new issue of Eurobonds. Thanks to this operation, Ukraine completely eliminated instruments that posed a significant risk to the sustainability of public finances," the Ministry of Finance reported.

According to the Ministry of Finance's estimates, without restructuring, payments on GDP warrants in 2025-2041 could have reached USD 6 to 20 billion, depending on economic growth rates.