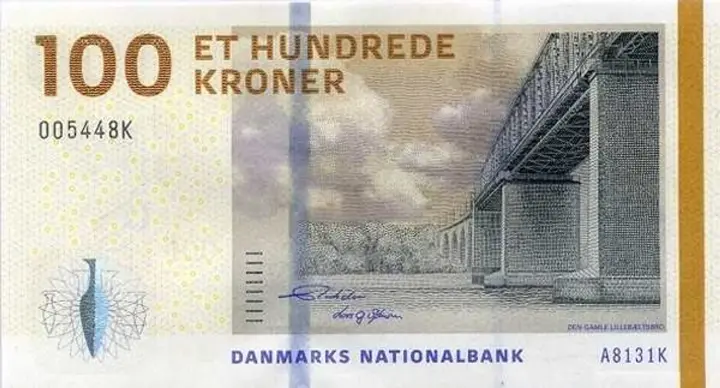

Danish krone falls to six-year low amid geopolitical uncertainty surrounding Greenland

Kyiv • UNN

The Danish krone has reached a six-year low amid discussions about US plans for Greenland. Investors are using the Danish currency to bet on the likelihood of the territory coming under US control, creating speculative pressure.

The Danish krone has recorded its lowest level in six years amid discussions about US President Donald Trump's administration's plans for Greenland. Investors are using the Danish currency as a tool to bet on the likelihood of the territory coming under US control, causing speculative pressure on the markets. This is stated in a Bloomberg article, writes UNN.

Details

The situation in the derivatives market confirms the negative dynamics: annual forwards indicate that in 12 months, the krone could trade at its lowest level in 10 months. According to Commerzbank currency strategist Michael Pfister, further exacerbation of the Greenland issue will only increase the risks.

Greenland rejects joining the US and remains in alliance with Denmark13.01.26, 19:08 • 4205 views

If this pressure on Greenland increases, the currency is likely to become more vulnerable

At the same time, the expert emphasized that the National Bank of Denmark has sufficient foreign exchange reserves and "probably did not intend to tolerate a huge devaluation." Direct tension between Washington and Copenhagen has turned the currency into an indicator of geopolitical threats.

Direct tension between the US and Denmark has drawn attention to the Danish krone as a potential barometer of risks associated with Greenland

Fixed exchange rate protection mechanisms

Currently, the Danish krone is approaching the 7.48 per euro mark, which Societe Generale SA analysts call a "historical defense zone." The officially established fluctuation corridor is 7.46038 per euro. Although the central bank has not intervened since January 2023, the availability of reserves exceeding $100 billion allows the regulator to stabilize the situation.

In addition to currency interventions, an interest rate hike is being considered, although such a scenario is currently considered unlikely.

A rate hike would be a last resort if the risks associated with Greenland materialize and have more far-reaching consequences

Bill introduced in US Congress to annex Greenland and grant it statehood12.01.26, 22:11 • 6608 views