Gold surpasses Bitcoin in volatility with sharpest price swings since 2008 crisis - Bloomberg

Kyiv • UNN

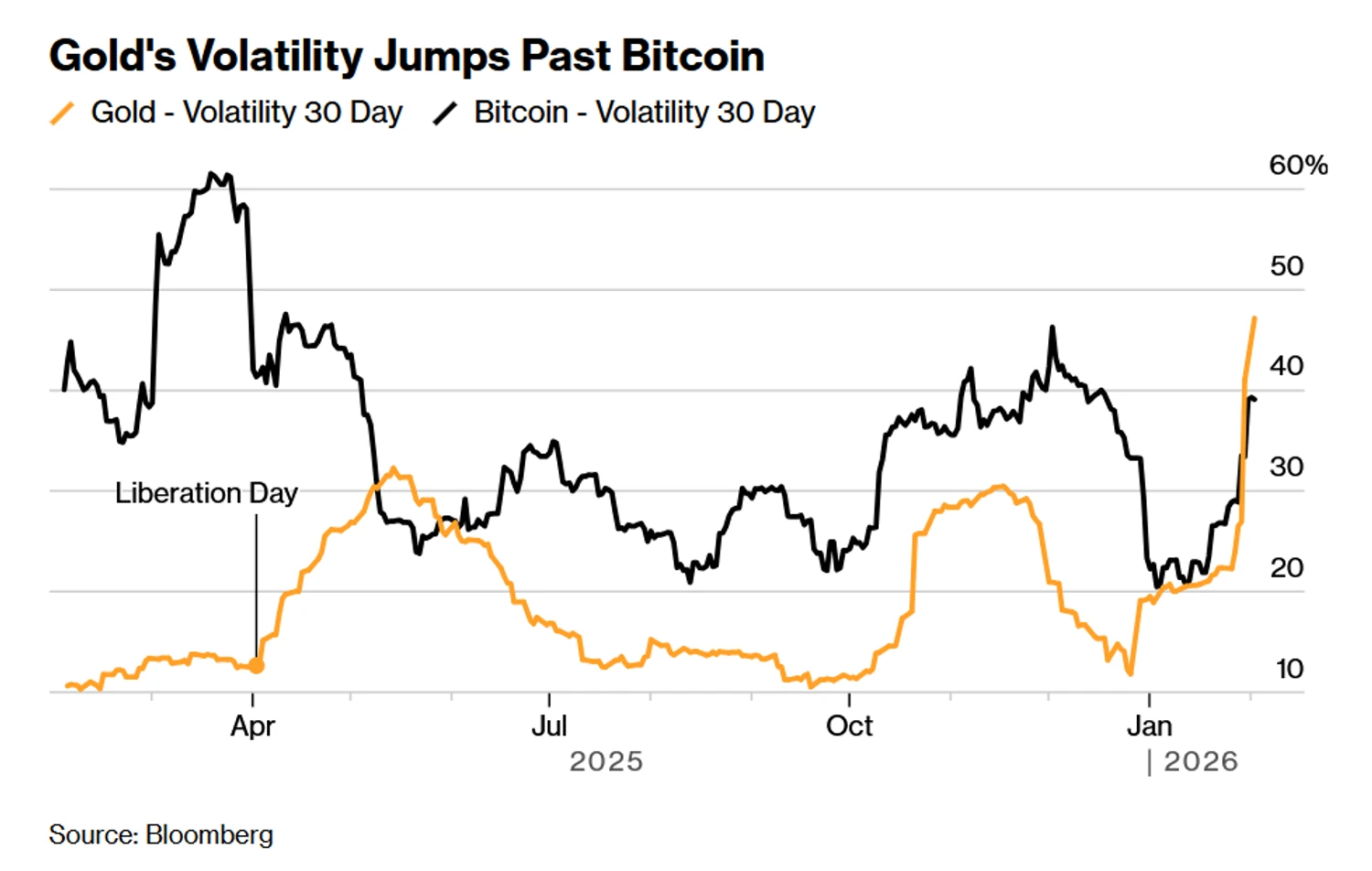

Gold's 30-day volatility exceeded 44%, the highest since 2008, surpassing Bitcoin. This occurred after a sharp 10% drop in gold prices and its rally to record highs.

Gold has become more volatile than Bitcoin, highlighting how the metal's rapid appreciation has given way to sharp price swings that can rival its most turbulent moments of the past two decades, Bloomberg reports, writes UNN.

Details

According to Bloomberg, the 30-day volatility (a measure of market price variability) of gold exceeded 44%, reaching its highest level since the 2008 financial crisis. This surpasses approximately 39% for Bitcoin, the original cryptocurrency, often referred to as "digital gold."

This marks an unusual reversal, as gold is typically seen as a more stable store of value than cryptocurrencies, which are known to be particularly prone to speculation. Since Bitcoin's creation 17 years ago, gold's volatility has been higher only twice, most recently last May during an escalation of trade tensions caused by US President Donald Trump's tariff threats.

The sharp increase in volatility followed gold's largest price drop in over a decade, continuing a sharp reversal of a rally that some traders believed had gone too far, too fast. Prices fell 10% on Monday, briefly dropping to almost $4,400 an ounce in Asian trading after peaking at around $5,600 last week.

Gold approaches $5600 amid increased demand for safe-haven assets29.01.26, 13:51 • 4111 views

Economic uncertainty has contributed to precious metal prices rising to record highs, shocking even seasoned market participants. The already rapid rally accelerated sharply at the beginning of the year, as investors actively invested amid renewed fears of geopolitical risks, currency depreciation, and the independence of the US Federal Reserve. A wave of purchases by Chinese speculators further fueled the situation.

Bitcoin failed to benefit from the same factors. On Monday, after a weekend sell-off, the token fell to a 10-month low, continuing a more than 40% decline from its October peak. Despite geopolitical tensions, dollar weakness, and sharp fluctuations in metal prices, Bitcoin is not redirecting capital from precious metals, making gold a more unpredictable asset at this time, the publication writes.

However, gold has maintained its status as a more reliable safe-haven asset. Over the past 12 months, it has grown by approximately 66%, while Bitcoin has fallen by 21%.

Gold resumed rapid growth after a relative dip the day before30.01.26, 06:16 • 5389 views