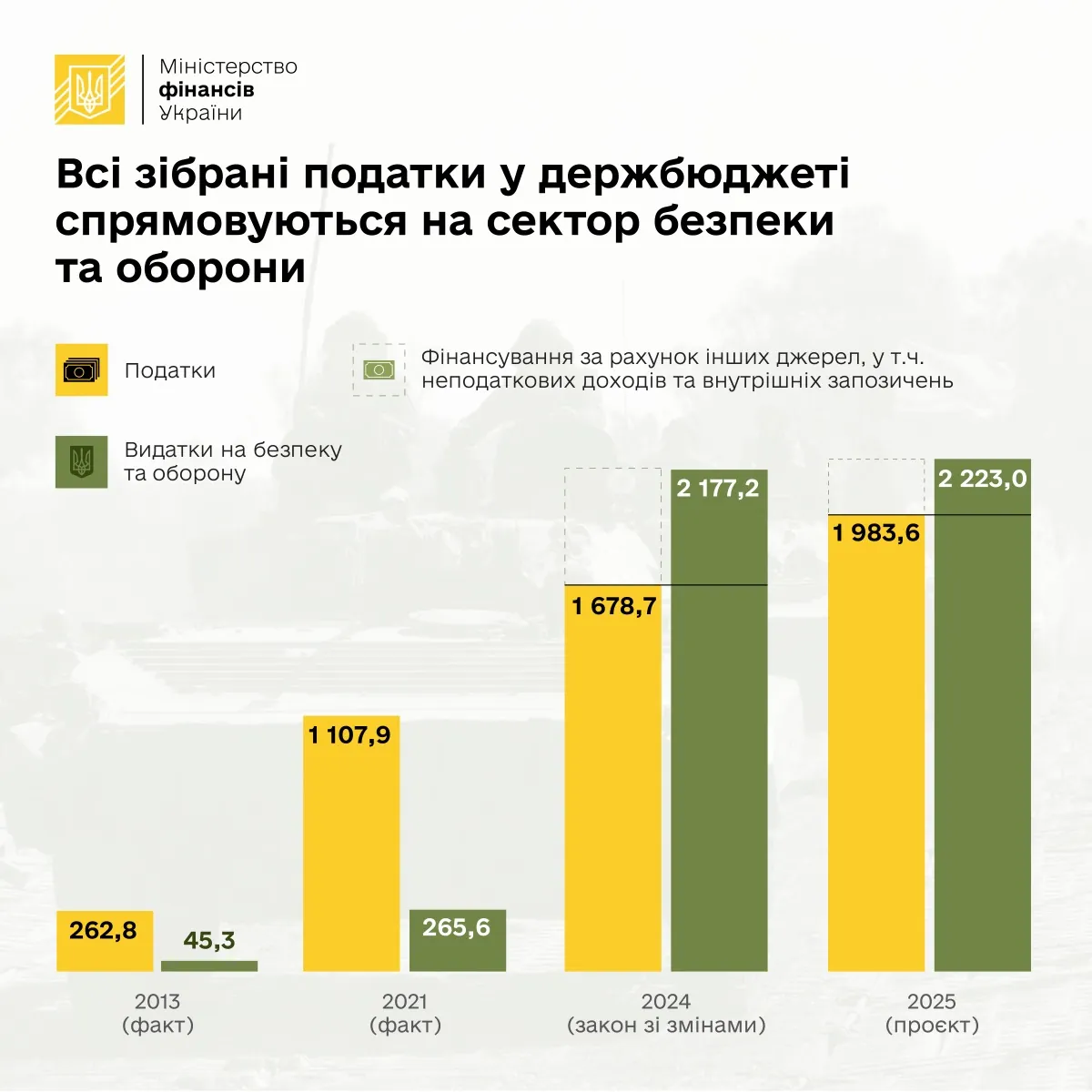

All taxes go to defense, but they are not enough - Ministry of Finance

Kyiv • UNN

Ukraine allocates all taxes collected to the security and defense sector, but this is not enough. The Ministry of Finance emphasizes the importance of adopting amendments to the Tax Code to ensure funding for the Armed Forces in 2024-2025.

Ukraine allocates all taxes collected to the security and defense sector. However, since this is not enough, the balance has to be covered by other sources, including non-tax revenues and domestic borrowing. This was stated by the Ministry of Finance of Ukraine, UNN reports.

Details

The Ministry of Finance noted that despite the lack of funds to finance all security and defense, tax rates have not increased since the start of the full-scale invasion - neither VAT, nor income tax, nor personal income tax, nor military duty.

On the contrary, in 2022, a number of benefits were introduced to support citizens and businesses and give them time to adapt to the new conditions.

As a result, in Ukraine in 2023, tax revenues to the consolidated budget, including the unified social contribution, amounted to 32.4% of GDP, which is lower even than the pre-war levels of 2013 (37%) and 2021 (33.1%)

The agency noted that the average level of taxes collected to GDP in OECD countries in 2022 was 34%. According to the OECD, in Poland, this figure was 35.2% in 2022, in Slovakia - 34.8%, and in Hungary - 33.2%.

Tax hikes proposed to be implemented “retroactively” - MP16.09.24, 11:30 • 39027 views

The growing needs of the security and defense sector, which are taking up all domestic resources, require the adoption of appropriate measures. That is why it is important to ensure the adoption of amendments to the Tax Code in the second reading in order to have the resources to finance the Armed Forces both by the end of 2024 and in 2025

Recall

A Verkhovna Rada committee has approved for the second reading a draft law on tax increases. The document proposes an increase in the military tax from 1.5% to 5%, as well as an increase in the bank profit tax to 50%