Tensions around Iran push oil prices up despite rising US inventories

Kyiv • UNN

Global oil prices are rising due to the escalating geopolitical situation around Iran, which negates the impact of increased US inventories. The US is considering seizing tankers with Iranian oil and deploying an aircraft carrier group.

Global oil prices have resumed their growth amid the escalating geopolitical situation around Iran, which completely negated the negative impact of data on a significant increase in commercial crude oil inventories in the United States. The market is ignoring signs of a surplus, focusing on the risks of potential supply disruptions from the Middle East if diplomatic negotiations fail. This is reported by Bloomberg, writes UNN.

Details

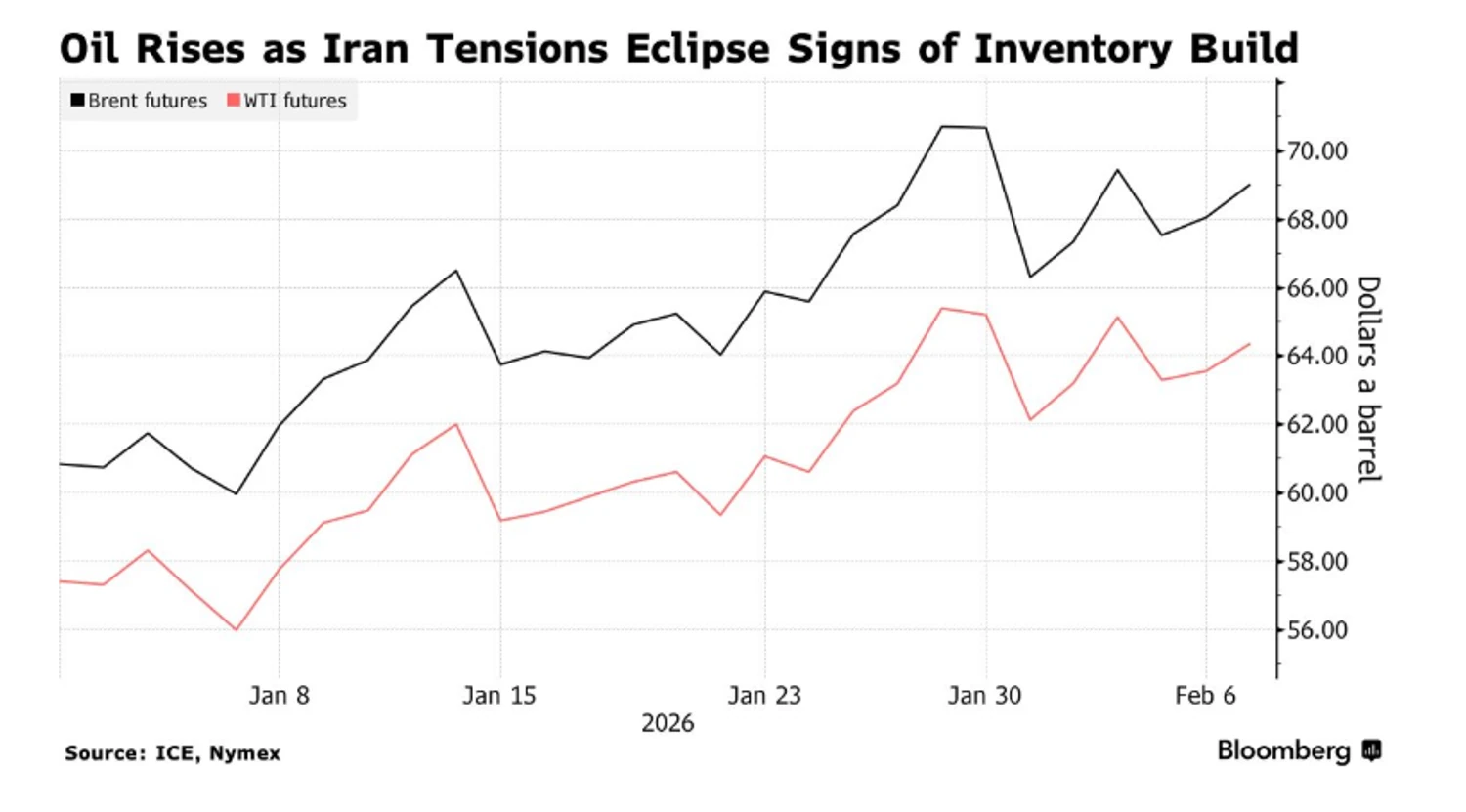

The price of West Texas Intermediate (WTI) crude oil rose above $64 per barrel, while the global benchmark Brent is trading at around $69. Traders are actively reacting to reports that the US is considering seizing tankers with Iranian oil and sending an additional aircraft carrier strike group to the region.

Such measures are seen as preparation for a forceful scenario if negotiations on Tehran's nuclear program reach an impasse.

Market surplus and energy agency reports

At the same time, internal data from the US indicate a significant market oversupply: the American Petroleum Institute (API) reported an increase in inventories of 13.4 million barrels last week. This is the largest figure since November 2023. If these figures are confirmed by the official government report, fundamental indicators may begin to put downward pressure on prices.

In the near future, investors are awaiting the monthly OPEC report and analysis from the International Energy Agency (IEA). The latter has already warned of a possible significant surplus of raw materials in 2026, as the growth rate of global supply currently outpaces demand. Nevertheless, as long as the geopolitical factor remains dominant, prices will maintain an upward trend.