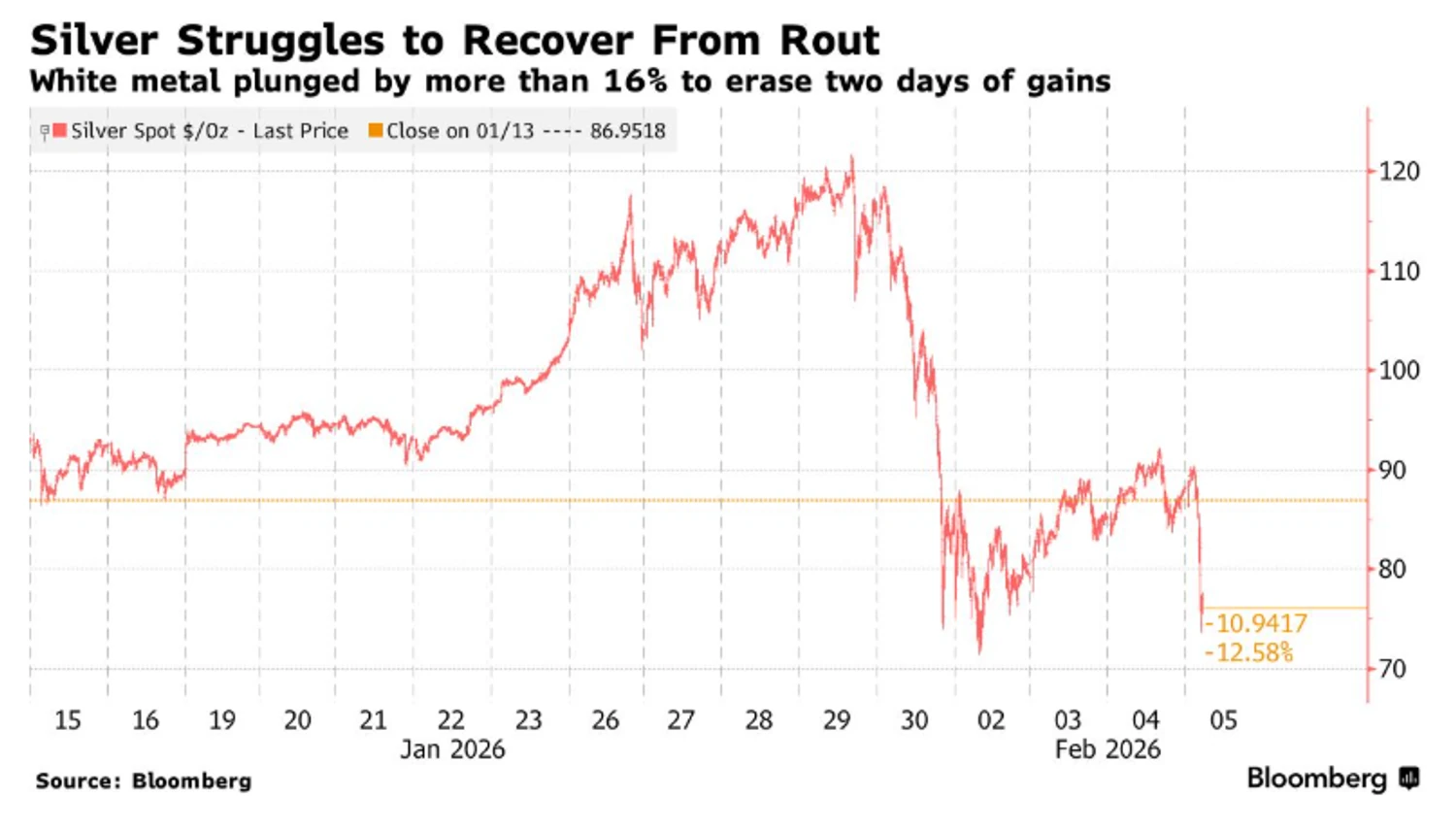

Silver plummets again: 17% drop negates market recovery attempts; gold also falls

Kyiv • UNN

The price of silver fell by 17% on February 5, negating a two-day recovery, while gold dropped by 3.5%. The decline is attributed to a massive exit from positions due to deteriorating sentiment and uncertainty surrounding the Fed.

The precious metals market is experiencing a new wave of turbulence: on Thursday, February 5, the price of silver fell by 17%, effectively erasing the results of a two-day recovery. After reaching an all-time high at the end of January, the white metal has already lost more than a third of its value, trying to find a new support level amid low liquidity and changing investor expectations. This is reported by Bloomberg, writes UNN.

Details

The sudden drop in the spot price of silver, which briefly exceeded $90 an ounce during Asian trading, is attributed by analysts to a "feedback effect." Christopher Wong, a strategist at Oversea-Chinese Banking Corp., notes that the deterioration in sentiment has affected most asset classes. This triggered a massive exit from leveraged positions, further exacerbating the collapse.

Gold also did not remain aloof, showing a 3.5% drop. The situation is exacerbated by a change in rhetoric regarding the US Federal Reserve. Kevin Warsh's nomination for Fed chairman has introduced uncertainty: although Donald Trump publicly supports interest rate cuts, Warsh's reputation as a proponent of tight monetary policy is forcing investors to re-evaluate inflation hedging risks.

Impact on the industrial metals market

The collapse of precious metals also dragged down the industrial sector. The price of copper fell by more than 1%, dropping below the psychological mark of $13,000 per ton. This indicates a general cooling of the speculative impulse that dominated the markets in January.

Standard Chartered experts warn that volatility will persist until there is a clear understanding of the Fed's next steps. Despite the current correction, many analysts consider it a "healthy pullback" after parabolic growth. They point out that structural factors - industrial silver deficit and demand from the AI and solar energy sectors - remain unchanged, which could lead to price stabilization in the second quarter of 2026.

Gold stabilizes after record fall: buyers return to market04.02.26, 05:41 • 4391 view