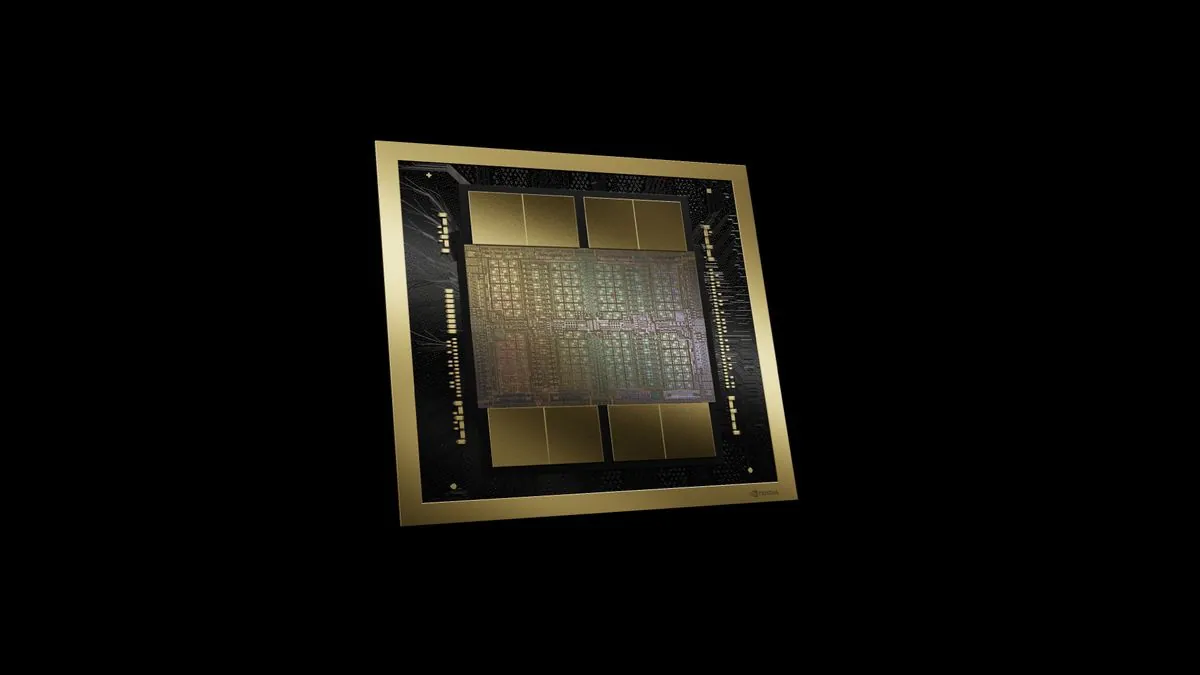

Nvidia reported that sales of new generation Blackwell chips will exceed previous forecasts

Kyiv • UNN

Nvidia reports an increase in the production of Blackwell chips, despite problems with overheating servers. The company expects to exceed revenue forecasts, although demand for chips exceeds supply.

Nvidia (NVDA) informed investors about a possible slowdown in the production of the next-generation Blackwell chip, and the company is confidently moving to exceed its previous revenue forecasts for the current quarter. UNN writes about this with reference to the financial information provider Yahoo! Finance.

Details

Nvidia (NVDA), the company that develops Blackwell chips, has announced that their production is "booming" and they plan to increase its volume. Currently, Nvidia is struggling with overheating problems of its Blackwell-based servers, which forces suppliers to adjust the design of the racks in which the servers are placed. The company responded that design iterations are normal and expected. The report referred to a separate Blackwell design issue that Nvidia resolved in the summer, which raised doubts on Wall Street about whether the chip would reach customers in time. In response, Nvidia (NVDA) said that the chips are already in the hands of all the company's major partners. In the third quarter, Nvidia reported that cloud service providers such as Microsoft, Amazon, and Google accounted for 50 percent of the chipmaker's data center revenue. And it is on how quickly they receive chips from the company that Nvidia's further growth depends.

However, the company is currently facing a problem that it is actively fighting against: supply constraints. This is because a large number of companies are competing for the AI giant's chips, which makes it difficult to meet demand.

"This is a case of demand exceeding supply," Nvidia CEO Jensen Huang told analysts. "And that's to be expected as we are at the beginning of this generative AI revolution.

According to Meta CEO Mark Zuckerberg, the social media giant trains its Llama 4 AI models on a server cluster consisting of more than 100,000 Nvidia H100 chips.

H100 is Nvidia's previous generation Hopper AI accelerator. Since Blackwell promises much better performance than Hopper, it makes sense that large AI companies like Meta would be eager to get their hands on as many of these chips as possible.

On Wednesday, Nvidia reported that its earnings results exceeded Wall Street estimates. Revenue jumped 94% year-on-year, and data center sales grew 112%. However, the shares fell in early trading on Thursday.

This is not the first time that the market has turned away from Nvidia after the company posted strong revenue growth. Investors pulled back after the company's latest earnings report and then started to rise again in the following weeks, making Nvidia the largest publicly traded company in the world, surpassing Apple earlier this month.

Recall

Nvidia investors expect stock volatility after the third quarter report, which could change the market value by $300 billion. Analysts predict a drop in profitability to 74.4%.