US stock indices ended trading on Wednesday with a sharp rise. Investors enthusiastically reacted to US President Donald Trump's statement about reaching a "framework agreement" on Greenland with NATO Secretary General Mark Rutte. This decision avoided the introduction of tough tariffs on goods from eight European countries, which were supposed to come into force on February 1. This was reported by Reuters, writes UNN.

Details

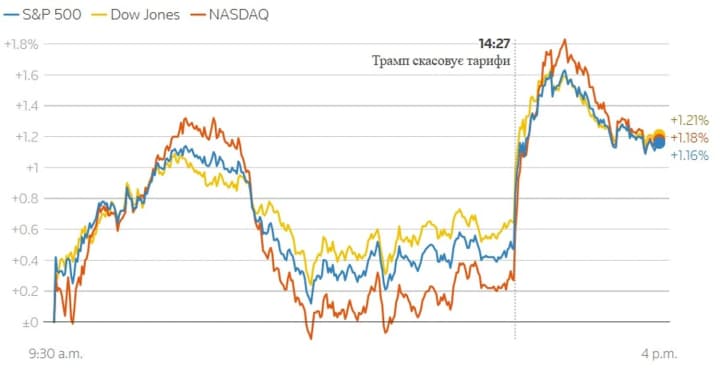

After the worst day in months, the market showed an impressive recovery. The S&P 500 index showed its largest one-day gain in two months, rising to approximately 6885 points. The Dow Jones Industrial Average and Nasdaq Composite also ended the day with gains of about 1.2% each. Such optimism sharply contrasts with the panic sell-off the day before, when the threat of a new trade war with the EU caused a collapse in quotes.

Global gold and silver prices set new historical records20.01.26, 21:26 • [views_6733]

Market experts, including analysts from Glenmede and JPMorgan, note that Wall Street remains extremely sensitive to geopolitical headlines. Despite the joy of tariff cancellation, the investment strategy of many funds remains cautious, as negotiations on Greenland's status and the presence of American air defense systems there are still ongoing.

Markets breathed a sigh of relief when Trump ruled out the use of military force to acquire Greenland

Wall Street stabilized thanks to AI boom and falling oil prices - AP16.01.26, 01:36 • [views_4717]