Rules are not for everyone: the State Tax Service ignores submission of declarations to the NACP

Kyiv • UNN

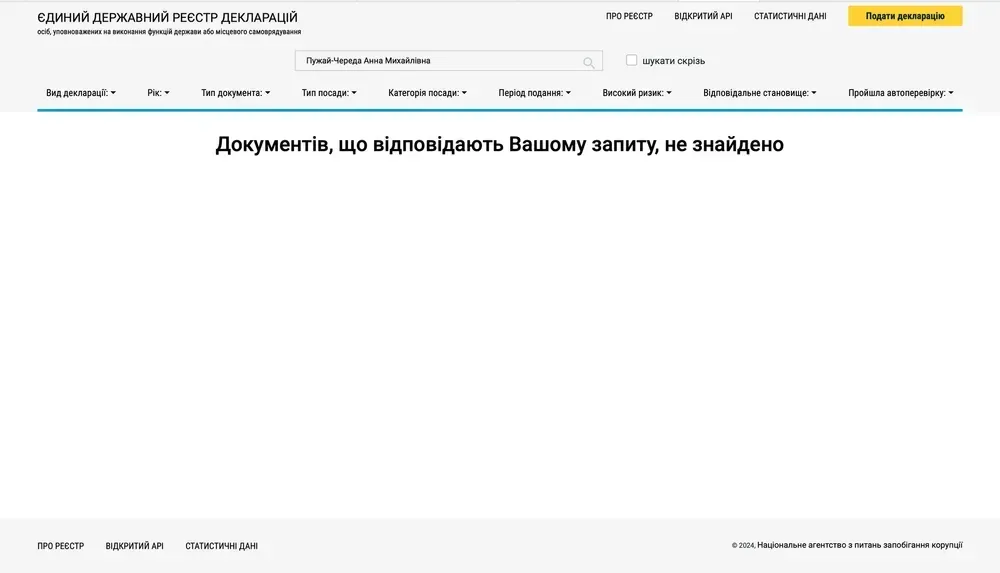

Anna Puzhay-Chereda, deputy head of the Central Interregional Department of the State Tax Service for work with large taxpayers, has never filed a declaration with the National Agency for the Prevention of Corruption.

Anna Puzhay-Chereda, deputy head of the Central Interregional Department of the State Tax Service for work with large taxpayers, who was accused of organizing schemes to extort money from entrepreneurs, has never filed a declaration with the National Agency for the Prevention of Corruption.

The Central Interregional Department of the State Tax Service for Large Taxpayers has announced the completion of the corporate income tax declaration campaign based on the results of financial and economic activities in the first quarter of 2024. According to the department, income tax accruals for the first three months of this year amounted to UAH 26.7 billion, which is UAH 7.5 billion more than in the same period of 2023.

Despite the tax authorities' requirements for businesses to submit declarations on time, civil servants themselves do not comply with the law in this area.

In particular, the deadline for submission of such reports by civil servants, including tax officials, expired on March 31. UNN examines the declarations of tax authorities' management, but as it turned out, Anna Puzhay-Chereda, deputy head of the Central Interregional Department of the State Tax Service for work with large taxpayers, has never submitted reports to the National Agency for the Prevention of Corruption.

It is worth noting that she has been working in the tax service since 2016. In particular, from December 2016 to March 2020, Puzhai-Chereda held the position of Deputy Head of the Main Department of the SFS in Zaporizhzhia Oblast. During this period, journalists drew attention to her activities, and local entrepreneurs complained about the tremendous pressure from the tax authorities. Business representatives demanded that Puzhai-Chereda be dismissed because she had allegedly organized extortion schemes.

At one of the meetings of the Zaporizhzhia Regional Coordination Council for Entrepreneurship Development , business representatives stated that tax authorities demand different amounts for not scheduling inspections, ranging from 3 thousand to 50 thousand dollars.

This is extortion. There is no other way to call it. We have many such facts. Several members of the Business Union have been victims of pressure from various law enforcement agencies. For example, the State Fiscal Service resumed criminal proceedings against Elit-Design after two years. The company Agro-Dom, which operates in the "white" sector, was offered to "share money with the budget" to avoid tax audits from cooperation with suspicious contractors

At the same time, Business Union demanded the dismissal of Anna Puzhay-Chereda, deputy head of the SFS in Zaporizhzhia region, who was in charge of all the scandalous inspections.

How the scheme worked

Puzhay-Chereda, relying on her extensive experience in the tax authorities, chose a well-established scheme that had been working for years. According to media reports, first the business received a request from the district head of the tax office to "voluntarily" pay a tidy sum to the budget, and was threatened with an audit "with all the ensuing consequences" in case of refusal, and then the company was urgently included in the audit plan.

The tax authorities didn't even bother to notice that the notice of urgent audit was sent before any changes were made to the plan. Then the audit took place, during which the entrepreneurs had to provide all the requested documents upon request. During the audit, the tax authorities "discovered" a fictitious company and, as a result, drew up an act on the need to pay the amount they had previously announced.

When Anna Puzhai-Chereda took office, the scheme started working with renewed vigor, the only thing that changed was that entrepreneurs had to resolve issues at the level of the regional SFS directly with the tax officer.

After all, it was Puzhay-Chereda who chaired the commission that considered the entrepreneur's objections to the results of the tax audit, which, by the way, were never taken into account.

What happened next

Under pressure from entrepreneurs and allegations of extortion schemes, the tax authorities finally gave in and fired Anna Puzhay-Chereda from the State Fiscal Service.

To wait out the active phase of the scandal, she was appointed deputy head of the regional office of the State Property Fund in Kyiv. After a four-month break, when passions had calmed down, Puzhay-Chereda decided to return to the tax office. Apparently, she had enough "earned" to get the post of Deputy Head of the Office of Large Taxpayers of the State Tax Service and even become the acting head.

Even after the reform, she remained in office and still works as the deputy head of the Central Interregional Department of the State Tax Service for work with large taxpayers

Business representatives have been complaining over the past few years that the pressure on them from the tax authorities has increased dramatically. Therefore, we can assume that Puzhay-Chereda has not forgotten about the "well-established scheme" and its scale has increased.

Therefore, it is not surprising that the NACP's Unified Register of Declarations still does not contain a single declaration by Anna Puzhay-Chereda. It is likely that the official would have to explain for a long time how she got her wealth.